Tuition Hikes

Disastrous to College Assurance Firms

Filipino parents’ dreams of ensuring their children’s

college education through pre-need plans continue to be shattered with the

closure of the country’s first ever college assurance company.

By Carl Marc Ramota

Bulatlat

The deregulation of college tuition through the enactment of the Education

Act in 1982 opened the doors for a sharp rise in tuition, making higher

education more elusive if not impossible to many students for the last two

decades.

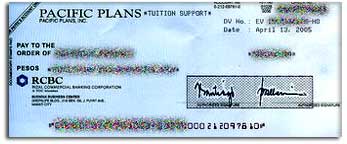

Pacific Plans check |

In turn, this has prompted many parents to avail of educational plans to

secure their children's college education. In the beginning, the budding

pre-need education industry seemed to provide the remedy. To date, the

P150-billion industry is growing at a phenomenal double-digit rate with

some four million plan beneficiaries. |

To many parents however the recent unexpected downfall of the first

pre-need firm in the

country - Pacific Plans Incorporated (PPI) - following the same fate of

industry leader College Assurance Plan (CAP) paint a grim picture.

Worse, more pre-need firms are expected to follow PPI’s fate. As early as

2002, the Securities and Exchange Commission (SEC) admitted that more than

90,000 pre-need plan holders were left high and dry when 13 pre-need firms

were either suspended or gone bankrupt.

In the end, the plan holders are the biggest losers. With the successive

collapse of pre-need firms, the dreams of thousands of parents and their

children for a college education are left in a shambles.

Rehabilitation?

Last April 23, some 2,000 PPI plan holders converged at Saint Paul's

College’s Pasig gym to protest a recent court ruling allowing PPI's

petition for rehabilitation.

Earlier on April 14, Makati Regional Trial Court Judge Romeo Barza issued

a stay in order allowing PPI "to stop paying its obligations until the

company is rehabilitated." In its petition for rehabilitation, the 38-year

old company is given five years or until 2010

to put its fiscal house in order.

In a statement, the Yuchengco-owned company blamed the incessant tuition

hikes for its financial woes. "The deregulation of tuition,” a company

statement said, “has caused a tremendous rise in the cost of education,

which in turn put

an enormous pressure on traditional (open-ended) plans and their

respective trust funds considering that pre-need companies dealing in such

securities could not pass on the additional cost to their planholders."

PPI also blamed the

devaluation of the peso which has "resulted in a poor business climate,

compromising a pre-need company's ability to meet its obligations."

Pacific Plans' trust fund is estimated at $50 million, consisting mostly

of the liquid assets in the U.S. dollar-denominated National Power Corp. (Napocor)

bonds maturing in 2010.

”Surprised” SEC

Apparently, even the SEC was caught off guard with PPI's move. SEC

Chairman Fe Barin admitted that the Commission was "caught by surprise,"

as there was no sign of a liquidity problem with Pacific Plans based on

the financial statement submitted to the

commission.

Before the PPI folded up, SEC even approved in August 2004 the company’s

application for a "corporate restructuring" which effectively transformed

it into a “special purpose vehicle” left holding all the problematic

pre-need investments.

Curiously, the safe pre-need products, those offering fixed benefits, were

transferred to a new company, Lifetime Plans. After securing the

divestment, PPI's board of directors led by its chairperson and president,

Helen Y. Dee, resigned en masse.

The Yuchengcos

brought along with them about 400,000 pre-need plans into Lifetime Plans,

leaving Pacific Plans with 34,000 open-ended, traditional education plans.

In the open-ended education plans the company is obliged to pay tuition at

any rate, unlike fixed-value plans.

Angry plan holders

To appease angry plan holders, PPI offered an interest of seven percent on

educational plans for those who can wait until 2010. The interest offer is

lower compared to prime time deposit accounts offered in some banks which

give 8.5 percent earnings.

PPI said it can still pay the tuition of plan holders but only as "tuition

support," the amount of which will still be determined by the school type.

In a statement, PPI spokesperson Jeanette Tecson said "the company will

pay most of the educational claims for non-exclusive or less expensive

schools but will only shoulder less than half the claims of those enrolled

in schools with high tuition." In this payment scheme, Pacific Plans will

provide only P28,000 for semestral plan holders, P29,000 for annual plan

holders and P22,000 for trimester plan holders.

But the tuition support is not enough, angry plan holders reacted, adding

they "felt deprived and cheated of their money." In the recent April 23

PPI plan holders meeting, a plan holder commented that the company pledges

were all part of “a greater scheme to legitimize their position to file a

petition for rehabilitation."

Another plan holder

said the PPI brouhaha can be considered as a "grand-scale estafa." They

also blamed the SEC for being "toothless" in protecting the welfare of

pre-need consumers.

Among those who flocked to St. Paul

was Elizabeth Centeno on behalf of her sister Anabelle Macalinao, who is

working in Dubai. Macalinao, a widow, availed of an educational plan for

her 13-year old son John Paul before she left for Dubai four years ago.

Centeno said she was surprised when she first heard the news and quickly

called her sister abroad.

"Nagulat din yung sister ko. Shocked siya. Iniisip niya safe na yung

edukasyon ng anak niya nung kumuha siya ng plan” (She was also

surprised. She was shocked. She assumed her son's education was already

assured when she availed of a plan.), Centeno said quoting her sister.

Centeno admitted she and her sister fear for John Paul's college education

now that it is uncertain whether they can still refund their payment from

Pacific Plans. "Hindi rin natin masasabi na laging may

pera para sa pag-aaral ng bata" (We really can't tell if we will

always have the money for the child's education), she told Bulatlat.

Distressing signal

In a statement, Anak ng Bayan Youth Party Vice President Raymond Palatino

blamed the Education Act of 1982 for the current pre-need industry crisis.

"Pacific Plans and CAP's downfall merely highlight how the cost of

education, particularly in the tertiary level, has

dramatically increased after the deregulation of tuition," he said.

He predicted that more pre-need firms are doomed to close this coming

school year unless the government starts to arrest the incessant tuition

hikes in tertiary schools.

In a recent study, Anak ng Bayan (nation’s youth) projects that if the

average tuition

rate increase of 12 percent continues over the next five years, the

national average per unit would reach P590.20 by 2010. By then tuition

would have increased by as high as 1,257.41 percent since 1990.

Palatino said the closure of pre-need firms sends a distressing signal to

college hopefuls. "Parents and students apply for pre-need plans to ensure

that they may be able to shoulder the high cost of tertiary education,” he

said. “With pre-need firms now closing, access to higher education has

become more elusive to many."

He also predicted an upsurge in the rate of college dropouts and number of

out-of-school youth in the coming school year. Bulatlat

BACK TO

TOP ■

PRINTER-FRIENDLY VERSION ■

COMMENT

© 2004 Bulatlat

■

Alipato Publications

Permission is granted to reprint or redistribute this article, provided

its author/s and Bulatlat are properly credited and notified.